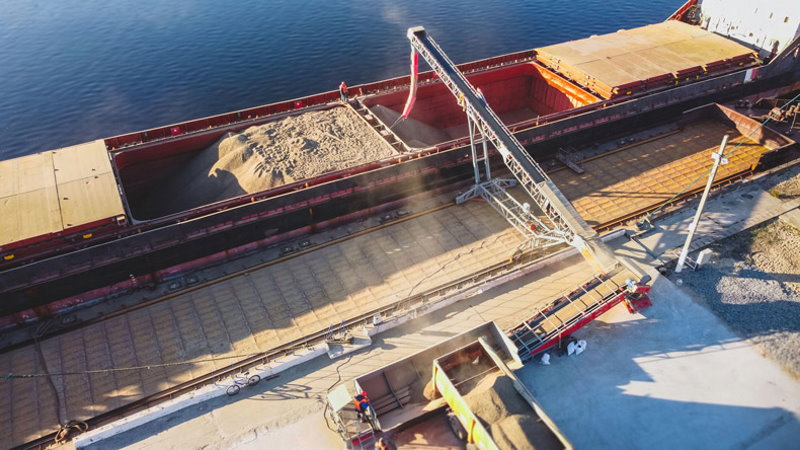

Black Sea grain Initiative extended for 120 days

The Black Sea grain Initiative, that was set to expire this Saturday, is extended for 120 days.

“I welcome the agreement by all parties to continue the Black Sea grain initiative to facilitate the safe navigation of export of grain, foodstuffs and fertilisers from Ukraine,” UN Secretary General Antonio Guterres said in a statement.

Russia’s foreign ministry also confirmed the extension of the Black Sea grain deal for 120 days starting from Nov. 18, without any changes to the current one. Hence, the deal will continue with the same provisions as it did before: Ships will carry grain from three Ukrainian ports: Chornomorsk, Odesa and Yuzhny/Pivdennyi; they will travel through the humanitarian corridor set up in the Black Sea and will be checked by inspectors from Russia, Ukraine, Turkey and the U.N. in Istanbul.

Star Bulk frees two of three vessels from Ukraine waters under grain pact

New York-listed owner rolls to third-quarter profit but misses analyst expectations in weaker market

Greek dry bulk giant Star Bulk Carriers has managed to sail two of its vessels safely out of Ukrainian waters under grain-export agreements while a third remains in place under war-risk insurance coverage.

Star provided the update on Wednesday in a quarterly earnings report that revealed a third quarter profit in a softer market that fell below expectations of Wall Street analysts.

The Petros Pappas-led bulker owner said its 82,200-dwt Star Helena and 82,200-dwt Star Laura (both built 2006) had been able to safely navigate out of Ukraine and “are now normally trading”. Meanwhile, efforts continue to free 82,400-dwt Star Pavlina (built 2021), which is manned by Ukrainian crew and has additional war-risk insurance.

“We continue to closely monitor the situation to ensure that the interests of all stakeholders are safeguarded,” Star said in the report.

On the financial front, Star Bulk is continuing to churn out profits – just not as large amid a weakening market and below what industry researchers had projected.

The Greek company reported adjusted net income of $136m, or $1.33 per share, which was lower than the analyst consensus of $143m, or $1.41 per share, according to a client note from Stifel analyst Ben Nolan.

Net voyage revenue of $272m also fell below projections of $286m, as did adjusted Ebitda at $164m versus an estimate of $196m.

The trend continued with Star Bulk‘s quarterly dividend, which at $1.20 per share was lower than the $1.30 per share consensus.

A weaker market was the culprit, as Star Bulk’s fleet-average time charter equivalent (TCE) rates came in at $24.365, which was 20% lower than the $30.626 earned in the third quarter of 2021.

Star Bulk‘s quarterly numbers a year ago were higher across the board — adjusted net income of $224.7m or $2.19 per share on adjusted Ebitda of $278m.

“With continued elevated high sulphur/low sulphur fuel price spreads, our investment in scrubbers has contributed meaningfully to profitability for the quarter, strengthening our earnings and providing downside protection during seasonal downturns,” Pappas said in the statement.

“With the dry bulk orderbook at an all-time low and with new environmental regulations coming into force and expectations of a gradual reopening of the Chinese economy, we remain optimistic about the long term prospects of the dry bulk market despite global macro uncertainties.”

Pappas said TCE for the quarter had exceeded applicable Baltic indices by 50%.

Star Bulk also disclosed it had booked 66% of days in the fourth quarter at a TCE average of $22,772 per day.

The Greek shipowner also has been busy on the financial front. Star said it had refinanced three facilities ranging from $24m to $47m with lenders NTT Finance, CTBC Bank and Standard Chartered Bank.

These contribute to a total of nearly $403m in refinancings over the course of 2022 that are touted to save $4.9m annually in interest margin.

“While the results were not overwhelming, the dividend still represents a healthy yield,” Nolan told clients. “Given the softness in shares recently, we expected [Star Bulk] should trade in line with the group or perhaps a premium tomorrow.”